.jpg)

When an asset or a good is sold off, its selling price is the salvage value if tax is not deducted then this is called the before tax salvage value. You can find the asset’s original price if the salvage price and the depreciation rate are known to you with the salvage calculator. The car salvage value calculator is going to find the salvage value of the car on the basis of the yearly depreciation value. Enter the original value, depreciation rate, and age of asset in tool to calculate the salvage value. Next, the annual depreciation can be calculated by subtracting the residual value from the PP&E purchase price and dividing that amount by the useful life assumption. The useful life assumption estimates the number of years an asset is expected to remain productive and generate revenue.

Центральний ринок (Central Market Hall)

The salvage value is the estimated residual value of the asset at the end of its useful life. Salvage value, also known as residual value or scrap value, is a fundamental concept in accounting and asset management. It refers to the estimated value that an asset will have at the end of its useful life. Understanding how to accurately calculate salvage value is essential for businesses to manage their assets effectively. It’s based on what the company thinks they can get if they sell that thing when it’s no longer useful. Sometimes, salvage value is just what the company believes it can get by selling broken or old parts of something that’s not working anymore.

How to Calculate After Tax Salvage Value: A Complete Guide

There’s also something called residual value, which is quite similar but can mean different things. Sometimes, it’s about predicting the value of the thing when a lease or loan ends. Other times, it’s about figuring out how much it’s worth when it’s done for good, minus the cost of getting rid of it.

How to Calculate Salvage Value

By the end of the PP&E’s useful life, the ending balance should be equal to our $200k assumption – which our PP&E schedule below confirms. In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life.

- It is a method of recognizing the decline in value and the wear and tear of an asset over time.

- After following this guide, you have now completed your first calculation with this method.

- In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life.

- On the other hand, book value is the value of an asset as it appears on a company’s balance sheet.

- If a company wants to front-load depreciation expenses, it can use an accelerated depreciation method that deducts more depreciation expenses upfront.

In the example, the machine costs $5,000, has a salvage value of $1,000, and a 5-year life. With a 20% depreciation rate, the first-year expense is $800, and the second year is $640, and so on. The chosen depreciation method influences the child tax credit definition book value of the asset, impacting the gain or loss on disposal. This method assumes that the asset’s value decreases at a constant rate over time. Older assets with shorter remaining useful lives generally have lower salvage values.

For example, if a company sells an asset before the end of its useful life, a higher value can be justified. This difference in value at the beginning versus the end of an asset’s life is called « salvage value. » Salvage value is important in accounting as it displays the value of the asset on the organization’s books once it completely expenses the depreciation. It exhibits the value the company expects from selling the asset at the end of its useful life.

It’s the expected residual value of the asset after accounting for aspects like depreciation, age-related wear and tear, and obsolescence. The salvage value of a business asset is the amount of money that the asset can be sold or scrapped for at the end of its useful life. Anything your business uses to operate or generate income is considered an asset, with a few exceptions. Salvage value is a critical concept in accounting and financial planning, representing the estimated residual value of an asset at the end of its useful life.

You can stop depreciating an asset once you have fully recovered its cost or when you retire it from service, whichever happens first. You’ve “broken even” once your Section 179 tax deduction, depreciation deductions, and salvage value equal the financial investment in the asset. This way, the salvage value helps in determining the depreciation; which is an integral part of accounting.

Think of it as your asset’s future garage sale price after it’s done its duty for you. You could estimate it as a dollar figure or a percentage of what it initially cost you. The residual value salvage value formula provides insights into the potential residual worth of an asset.

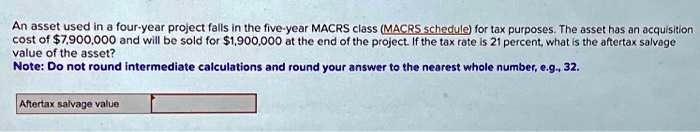

The double-declining balance (DDB) method uses a depreciation rate that is twice the rate of straight-line depreciation. Therefore, the DDB method would record depreciation expenses at (20% × 2) or 40% of the remaining depreciable amount per year. If a company wants to front-load depreciation expenses, it can use an accelerated depreciation method that deducts more depreciation expenses upfront. Many companies use a salvage value of $0 because they believe that an asset’s utilization has fully matched its expense recognition with revenues over its useful life. Calculating after tax salvage value is an essential aspect of managing assets and making informed financial decisions for businesses and individuals alike.

Commentaires récents